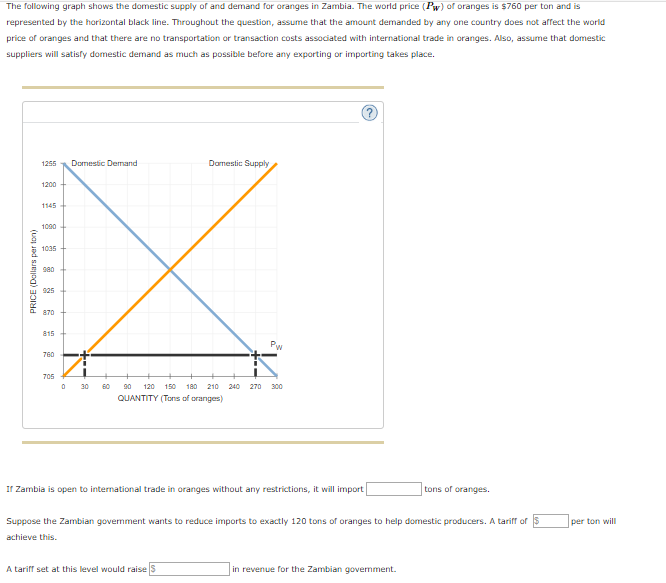

Taxable acquisition of ownership interests in business entities.Taxable acquisition of assets constituting a trade or business by the acquirer.Taking these allowable deductions reduces your tax liability, resulting in higher profits from the M&A. It may also refer to the date when the M&A terms are authorized or approved by the stakeholders in the transaction.ĭeductibility: Transaction costs incurred before the bright-line date, which do not directly facilitate a covered transaction, are generally deductible as ordinary and necessary business expenses under Section 162. Although the date may vary, it typically refers to when the M&A target and acquirer sign a letter of intent or exclusivity agreement. Goodwill can be associated with the “ synergies” of a merger and the combined intellectual property obtained after the dealīright-Line Date Rule: The exception to capitalization allows the deduction of certain transaction costs incurred before a specific date.Other specified transactions, such as transfers of intangible assets or changes in the ownership of copyrights, patents, or intellectual property.

Bright line date transaction costs how to#

When determining how to maximize the tax benefits of transaction costs, you must understand the IRS categorizes these expenses and the available deductions for companies that incur transaction costs.Ĭapitalization: Treasury Regulation §1.263(a)-5 generally requires capitalization of transaction costs for specific types of transactions. What are the Major Tax Implications of Transaction Costs? Fewer transaction costs can increase the profitability of a transaction therefore, managing transaction costs is crucial for maximizing the potential profitability of your M&A deal by providing additional tax deductions associated with the purchase of the asset(s). Higher transaction costs can cut into the returns, reducing the net profit realized from the purchase. These costs directly impact the total costs and potential profitability of an M&A deal. For instance, brokerage fees, legal fees, accounting fees, appraisal costs, and regulatory compliance expenses are transaction costs related to the purchase of the underlying asset. These costs can include fees associated with completing the transaction. For businesses that participate in M&A deals, transaction costs are an expected expense for closing the deal at the time of purchase. Transaction costs are the expenses you encounter when buying or selling an asset, like an investment or a business. Understanding the tax treatment of transaction costs and implementing strategies to maximize tax benefits associated with these expenses lets you experience increased profitability. These costs can significantly impact your realized gain and often offer tax advantages you can benefit from in future years with the right accounting approach. Transaction costs refer to fees for services provided by investment bankers, attorneys, accountants, and consultants during the transaction. One strategic approach involves the treatment of transaction costs incurred during an M&A. As your company participates in a deal, such as a merger and acquisition (M&A), you should seek tax strategies to maximize the transaction’s profitability.

0 kommentar(er)

0 kommentar(er)